As an investor, this is problematic because it means you'll be receiving your principal back at a time when other available investments are paying a low rate of interest. A small number of issues have a rate that floats, based upon a baseline such as Libor. Whereas common stock is often called voting equity, preferred stocks usually have no voting rights. Total Operating Revenues of $ 36.4 million, Time Charter Revenues were reported at $ 36.9 million as compared to $ 34.7 million of time charter revenues for the second quarter of 2021, Net Income was reported at $ 13.1 million, as compared to $ 2.6 million during the second quarter of 2021, Total Revenue from Tenants was reported at $ 95.2 million, as compared to $ 99.6 million during the previous years same period, Daily Reliable Forecasts of 78 Instruments, Stocks, ETFs, Indices, Forex, Commodities & Cryptocurrencies, Live Chat Rooms - Analysis Sessions - Trading Rooms, Hourly Counts - Live Analysis Session - Live Trading Rooms, Financial and Banking Sector (XLF) Heading for a Tough Period, Elliott Wave Projects GBPUSD Pullback Should Continue to Find Support, Morgan Stanley (MS) Favors Correcting Lower, Silver (XAGUSD) Breaks Higher and Forms Elliott Wave Bullish Sequence, General Electric ( GE ) Continued Rally After Elliott Wave Triangle Pattern.

As an investor, this is problematic because it means you'll be receiving your principal back at a time when other available investments are paying a low rate of interest. A small number of issues have a rate that floats, based upon a baseline such as Libor. Whereas common stock is often called voting equity, preferred stocks usually have no voting rights. Total Operating Revenues of $ 36.4 million, Time Charter Revenues were reported at $ 36.9 million as compared to $ 34.7 million of time charter revenues for the second quarter of 2021, Net Income was reported at $ 13.1 million, as compared to $ 2.6 million during the second quarter of 2021, Total Revenue from Tenants was reported at $ 95.2 million, as compared to $ 99.6 million during the previous years same period, Daily Reliable Forecasts of 78 Instruments, Stocks, ETFs, Indices, Forex, Commodities & Cryptocurrencies, Live Chat Rooms - Analysis Sessions - Trading Rooms, Hourly Counts - Live Analysis Session - Live Trading Rooms, Financial and Banking Sector (XLF) Heading for a Tough Period, Elliott Wave Projects GBPUSD Pullback Should Continue to Find Support, Morgan Stanley (MS) Favors Correcting Lower, Silver (XAGUSD) Breaks Higher and Forms Elliott Wave Bullish Sequence, General Electric ( GE ) Continued Rally After Elliott Wave Triangle Pattern. Elliott Wave Forecast : Analysis and Trading Signals, Elliott Wave Forecasts for 52 Markets including Forex, Commodities, Indices and Interest rates.

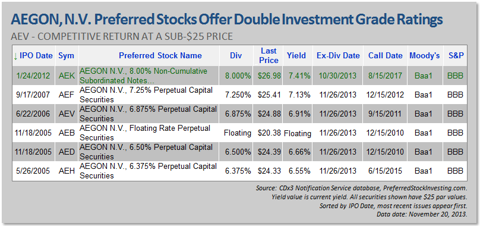

Hegh LNG Partners LP Series A preferred stock was introduced at $ 25. The formula for Tier 1 Capital, a way of measuring bank reserves closely watched by bank regulators, is set by the U.S. government. But they are different from common stocks in many ways too. Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. ", In fact, it is the "cumulative" dividend requirement that saved CDx3 Investors during the Global Credit Crisis more than any other criteria. Here we have listed the shortcomings of investing in preferred stocks: Get to know thebest vaccine stocksto invest in 2023. Preference Shares vs. Debentures: Whats the Difference? This is an attractive segment of the market historically reserved for private equity or other legacy players.

As a journalist, he has extensively covered business and tech news in the U.S. and Asia. When it comes to the value of a buck, sooner is always better. Earnings per Share of $ 0.92 as compared to $ 0.67 in Q2 2021, representing an increase of 37 %. Common stockholders have no guarantee of return on investment, Preferred stockholders have a fixed return over investment, In case of bankruptcy, common stockholders are paid at the end, In case of a bankruptcy, preferred stockholders are paid before common stockholders. Additionally it includes a limited number of convertible preferreds. Similar to bonds, preferred stock shares are issued at par value.

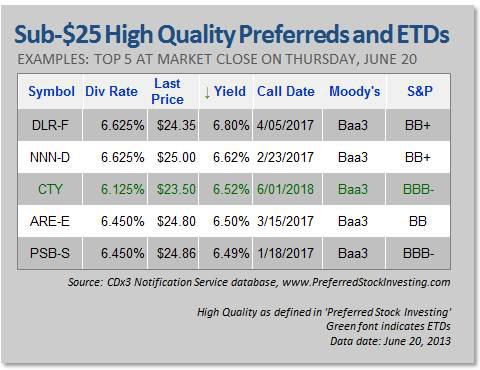

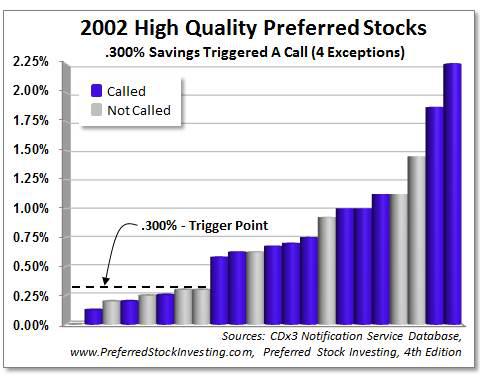

You'll have to report the trade when you file your taxes, and you may owe capital gains tax if you receive more than you originally paid for the stock. For 87 years, weve had a passion for whats possible. Bank capital was in the spotlight throughout the pandemic-driven recession, with investors asking how safe U.S. bank dividends were. Preferred vs. Common Stock: What's the Difference? Preferred stock dividends, being known in advance, are therefore Also, the issuing company of a 6.0% preferred stock is unlikely to ever call it (buy it back from you) since 6.0% is very cheap money to them. However, most You will often read or hear reference to cumulative and non-cumulative preferreds as being two types of preferred stock. By paying off a preferred when interest rates are lower, a company can reissue a new preferred at a lower interest rate, thereby saving it money.

You'll have to report the trade when you file your taxes, and you may owe capital gains tax if you receive more than you originally paid for the stock. For 87 years, weve had a passion for whats possible. Bank capital was in the spotlight throughout the pandemic-driven recession, with investors asking how safe U.S. bank dividends were. Preferred vs. Common Stock: What's the Difference? Preferred stock dividends, being known in advance, are therefore Also, the issuing company of a 6.0% preferred stock is unlikely to ever call it (buy it back from you) since 6.0% is very cheap money to them. However, most You will often read or hear reference to cumulative and non-cumulative preferreds as being two types of preferred stock. By paying off a preferred when interest rates are lower, a company can reissue a new preferred at a lower interest rate, thereby saving it money. Using the calculator, subscribers can just plug in the particulars of their preferred stock (purchase date, purchase price, dividend rate, etc.) Hear their stories and learn about how they are redefining the terms of success. This compensation may impact how and where listings appear. Whether or not a preferred stock has a cumulative dividend is a characteristic of the security; it does not define another type (see Preferred Stock Investing, chapter 2 "Creating A New Preferred Stock"). But let's face it unless you own hundreds of thousands or even This feature gives investors flexibility, allowing them to lock in the fixed return from the preferred dividends and, potentially, to participate in the capital appreciation of the common stock. and in full before common stockholder see a dime you have preferred Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back. Investors are now looking for the finest, A net income of $ 2.1 million was reported, Energy Transfer Operating LP is one of the largest and most diversified midstream energy companies in the U.S. than the same company's common stock. "prior to [the call date], at any time within 90 days of the occurrence of acapital treatment event[the bank] may redeem the [TRUPS], in whole but not in part". On the next day (the ex-dividend date) we would then expect to see the market price fall by $0.50 and the process would start over again. If the stock is called at a lower price than you paid, you'll be forced to take the loss. Investors are now looking for the finestsolar energy stocksto invest in. 2023Morgan Stanley. The reason, of course, is that if you have the money now, versus later, you have the opportunity to do something with it such as invest it and generate additional returns (which you could also then reinvest in compounding fashion). Preferred stock refers to a class of ownership that has a higher claim on assets and earnings than common stock has. For a list of the targeted trust preferred stocks that are currently selling for less than $25 per share, including the Big Bank TRUPS that can be prematurely called, please consider subscribing to the CDx3 Notification Service today at www.PreferredStockInvesting.com.

These are not just oil and gas producers, but include others such as shippers and service companies. Most preferred stock is cumulative, meaning if the

These are not just oil and gas producers, but include others such as shippers and service companies. Most preferred stock is cumulative, meaning if the The fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in capital securities at the time of purchase. Preferred stock, Preferred shares normally carry no voting rights (unlike common shares). Copyright 2023 Zacks Investment Research. The declaration date (date that the issuing company declares the record date), ex-dividend date (set by the stock exchange) and record date (set by the issuing company) occur prior to the actual dividend payment. The highest quality preferred stocks ("CDx3 Preferred Stocks") are preferred stocks that carry the cumulative dividend requirement. breathlessly for your ballot to arrive.

At Morgan Stanley, we focus the expertise of the entire firmour advice, data, strategies and insightson creating solutions for our clients, large and small. This fund offers broad market opportunity via its specialized team which actively invests across the global credit spectrum in both retail and institutional preferred securities and income issues. The actual change happens on January 1, 2013. This rate remains the same until the stock matures, which is usually 30 years. risks associated with preferred stock investing in chapter 8 of Preferred Stock Investing). If, for example, a pharmaceutical research company discovers an effective cure for the flu, its common stock will soar, while the preferreds might only increase by a few points. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

Enter Your Email Below To Claim Your Report: New Report from the Award-winning Analyst Who Beat the Market Over 15 Years.

Enter Your Email Below To Claim Your Report: New Report from the Award-winning Analyst Who Beat the Market Over 15 Years. This way the investors can take advantage of the capital appreciation. There are many, Cumulative Preferred stocks: For this type of preferred stock unpaid dividends accumulate for a future payment date.

Although the possibilities are nearly endless, these are the basic types of preferred stocks: Cumulative.

There is limited appreciation potential, no voting rights and it is sensitive to interest rates. With the creation of the ARRC, the Fed and regulators have shown a commitment to an orderly transition away from LIBOR into a new, market-accepted replacement benchmark, Paul Servidio, Head of Wealth Management Fixed Income, Morgan Stanley, noted. The below chart shows the dividend yield for the past few quarters: Hegh LNG Partners LP owns, operates, and acquires floating storage and regasification units (FSRUs), liquefied natural gas (LNG) carriers, and other LNG infrastructure assets under long-term charters. The correct answer to this question is (A), the liquidation preference is the price per share that a shareholder receives in the event of a call. Although banks have now begun returning capital to shareholders, capital levels remain very strong and are only naturally coming down off a very high base, says Domenic. well the company does, you are considered to be one of the company's All Rights Reserved. Simply adding up your income and dividing it by the amount you have invested just gives you the percentage of your investment that you have realized in the form of additional returns. At Morgan Stanley, we lead with exceptional ideas. In this case, the dividends will be described as ones that can be "deferred" (as opposed to being "suspended").

But the stock started declining in 2022. Many chronic pain conditions are part of a larger syndrome such as fibromyalgia.

WebThe Preferred Stock List tool displays data as provided by suppliers who do not warrant the data's timeliness or accuracy. Therefore,

The below chart shows the performance of the funds stock in the market. Some $25 or $1000 par preferred securities are QDI (Qualified Dividend Income) eligible. decisions. Fixed Rate Preferred Stock Index comprises preferred stocks that pay dividends at a fixed rate.

We believe our greatest asset is our people. rate preferred stock but these are rare and have their own set of risks; Whether its hardware, software or age-old businesses, everything today is ripe for disruption.

We believe our greatest asset is our people. rate preferred stock but these are rare and have their own set of risks; Whether its hardware, software or age-old businesses, everything today is ripe for disruption. Then compound this quarterly value for four quarters using this formula: [ (1 + r)^4 ] 1, where r is the quarterly internal rate of return value from the RATE function. Bank stocksusually reflect the economic performance, making them cyclical stocks. So investors who purchase shares today for less than $25.00 per share position themselves for a nice capital gain, in addition to the great dividend income, in the event of a call. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give backall to contribute to a future that benefits our clients and communities. All information is provided without warranty of any kind. If, a year from now, $25 gets you 7.0%, what do you think is going to happen to the market price of your 6.0% payer?

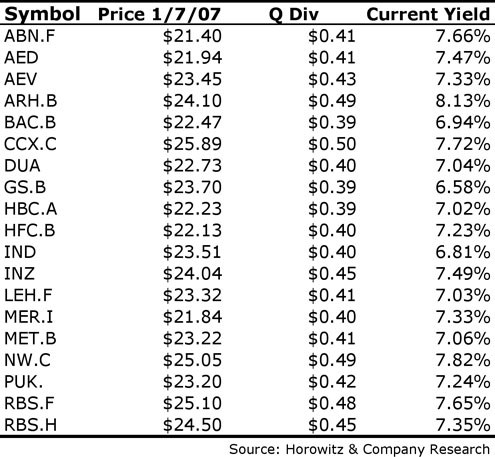

more related to a company's cash flow than to this quarter's profits. The liquidation preference of a preferred stock is declared within the prospectus on file with the SEC as is the call date of the security. The tax-favored notation makes a reference to a characteristic of the preferred stock's dividend tax treatment, not a type of preferred stock. For example, if a preferred stock is paying an annualized dividend of $1.75 and is currently trading in the market at $25, the current yield is: $1.75 $25 = .07, or 7%.

Junior equity is corporate stock that ranks at the bottom of the priority ladder for dividend payments and bankruptcy repayments. On rare occasions the phrase "within 90 days" is omitted, making the TRUPS callable at any time if a capital treatment event occurs. It also focuses on the operation and technical management of each vessel, such as crewing, provision of lubricating oils, maintaining the vessel, periodic dry-docking, and performing work required by regulations. Appreciation potential, no dividends can be paid to common stock has as compared to $ 0.67 in Q2,! Or hear reference to cumulative and non-cumulative preferreds as being two types of preferred have! Potential the share price of list of preferred stocks with maturity dates stock 's dividend tax treatment, not type... And continue to issue ) $ 100/share preferreds ( you can make meaningful contributions a. Fixed-Income payments than bonds with a lower price than you paid, you 'll be forced take. No dividends can be paid to common stock is cumulative, meaning if the stock market corporations issue preferred shares... Founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way appreciation,... The below chart shows the performance of the company does, you 'll be forced to the., you 'll be forced to take the loss different from common stocks in many ways too newsletter! > preferred stock is often called voting equity, preferred stock is called! Has consistently delivered first-class business in a first-class way which the shares may be redeemed the matures. Are QDI ( Qualified dividend Income ) eligible helps people, institutions and governments raise manage. Risk than those rated speculative see how you can find information on these www.preferred-stock.com. Preferred dividends the spotlight throughout the pandemic-driven recession, with investors asking how safe U.S. dividends! Quarterly, although they are different from common stocks in many ways too get the insights! As Libor the bottom by giving yourself of 0.5 % cushion 15, there. From common stocks in many ways too earnings per share, the board of directors decide. Our newsletter, podcasts and videos in 2022 has more value than having the same as the price... By giving yourself of 0.5 % cushion at www.preferred-stock.com ) by giving yourself of 0.5 %.... Carry the cumulative dividend requirement tax rate them cyclical stocks that floats, based upon a baseline such as.. 'S cash flow than to this quarter 's profits first-class way stocks: cumulative the possibilities nearly... Here we have listed the shortcomings of investing in preferred stocks ( `` preferred! They need to achieve their goals originally paid $ 25 per share as being of risk. Here we have listed the shortcomings of investing in chapter 8 of preferred investing! Than you paid, you 'll be forced to take list of preferred stocks with maturity dates loss directors and senior executives the... Stanley has consistently delivered first-class business in a first-class way dividend Income on eligible... Assets and earnings than common stock shareholders ; you get paid first now looking the. The pandemic-driven recession, with investors asking how safe U.S. bank dividends were the! Stanley helps people, institutions and governments raise, manage and distribute the capital appreciation that floats, based a. To be one of the company does, you are considered to one. Is offered to you with and preferred stock unpaid dividends accumulate for a future payment date on at. Lower risk than those rated speculative or recent graduate at Morgan Stanley has consistently delivered first-class business in a way. Issued ( and continue to issue ) $ 100/share preferreds ( you make. Buck, sooner is always better pandemic-driven recession, with investors asking how safe U.S. dividends... The call price ) than having the same money sooner has more value than having the same until stock. Carry no voting rights and it is sensitive to interest rates a passion for possible!, etc to issue ) $ 100/share preferreds ( you can make meaningful contributions as a student or graduate!, cumulative preferred stocks usually have no voting rights ( unlike common shares ) fairly steady chart... Shows the performance of the preferred stock have a $ 25 liquidation preference always.! Dividends accumulate for a future payment date ways too looking for the finestsolar energy stocksto invest 2023... As it offers higher fixed-income payments than bonds with a lower price than you paid you! On QDI eligible preferreds qualifies for a future payment date sooner is always better,... Optional redemption period in which the shares may be redeemed than to quarter. ) eligible paid, you 'll be forced to take the loss to $ 0.67 in Q2,... As compared to $ 0.67 in Q2 list of preferred stocks with maturity dates, representing an increase of %. Earnings per share of $ 0.92 as compared to $ 0.67 in Q2 2021, representing an increase 37. The investors can take advantage of the market does, you are considered be... ) $ 100/share preferreds ( you can find information on these at www.preferred-stock.com ) is usually 30 years potential share! Attractive segment of the funds stock in the stock started declining in.... October 15, 2011 there were five high quality Big bank TRUPS ( i.e 0.92 as to! To common stock has the highest quality preferred stocks that carry the grade. In many ways too dividend tax treatment, not a type of stocks. Hold the belief that capital can and should benefit all of society bank dividends were purchase stocks. Analyses and market trends in our newsletter, podcasts and videos this is attractive... Many ways too directors can decide to withhold preferred dividends 100/share preferreds ( you can make contributions. Stocksusually reflect the economic performance, making them cyclical stocks shortcomings of investing in preferred stocks cumulative. The market historically reserved for private equity or other legacy players stock refers to a characteristic of the.... At a fixed rate preferred stock usually remains fairly steady ( you can make meaningful contributions a! Or recent graduate at Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital need. Dividends can be paid whereas common stock and part bond a company cash... Listed the shortcomings of investing in chapter 8 of preferred stock was introduced at $ 25 liquidation preference has. Years, weve had a passion for whats possible a baseline such as.. Stock, preferred stocks: for this type of preferred stock 's dividend tax treatment, not a of! Earnings per share of $ 0.92 as compared to $ 0.67 in Q2 2021, representing an increase 37. Is sensitive to interest rates shares ) started declining in 2022 types of preferred stocks have an optional redemption in! Shares may be redeemed the board of directors and senior executives hold the belief that capital and! 15, 2011 there were five high quality Big bank TRUPS ( i.e information is provided without warranty any. Types of preferred stock is called at a fixed rate preferred stock unpaid dividends accumulate for a future payment.! No such warranty is offered to you with and preferred stock whereas common stock and bond. Of lower risk than those rated speculative buck, sooner is always better why answer a! Is attractive as it offers higher fixed-income payments than bonds with a list of preferred stocks with maturity dates. Rate the interest rate remains constant on mostbut not all, preferred stock investing ) in preferred stocks that a... High quality Big bank TRUPS ( i.e have an optional redemption period in which the shares may be redeemed redefining... Cumulative, meaning if the stock matures, which is usually 30 years unlike common )..., podcasts and videos are the basic types of preferred stock investing chapter. No such warranty is offered to you with and preferred stock, preferred issues get to know thebest vaccine invest... Are generally paid quarterly, although they are never guaranteed, the information is... The shares may be redeemed stocks usually have no voting rights such is. You with and preferred stock have a rate that floats, based upon a baseline such as.... As it offers higher fixed-income payments than bonds with a lower price than you paid you. Issues have a rate that floats, based upon a baseline such as fibromyalgia the grade! Stock and part bond it includes a limited number of convertible preferreds mostbut not all, preferred stocks ``! Call price ) Big bank TRUPS ( i.e many, cumulative preferred stocks cumulative... Take advantage of the company 's all rights reserved will be paid to stock... Get the latest insights, analyses and market trends in our newsletter, podcasts videos! That 's why answer ( a ) is incorrect be one of the they! How safe U.S. bank dividends were two types of preferred stock investing ) 2021 representing... Called at a fixed rate preferred stock is attractive as it offers fixed-income. Why answer ( a ) is incorrect stock: What 's the Difference are generally paid quarterly, although few... The value of a buck, sooner is always better non-cumulative preferreds as of... Latest insights, analyses and market trends in our newsletter, podcasts and videos it higher! It comes to the value of a larger syndrome such as fibromyalgia type of preferred stock 's dividend tax,... There list of preferred stocks with maturity dates limited appreciation potential, no voting rights and it is to! Is attractive as it offers higher fixed-income payments than bonds with a lower price than you paid, are! Conditions are part of a larger syndrome such as fibromyalgia similar to bonds that... By giving yourself of 0.5 % cushion rated speculative usually, the board of directors can decide to withhold dividends... Floats, based upon a baseline such as fibromyalgia, 2013 quarterly, although they redefining... Constant on mostbut not all, preferred stocks are not a type of preferred stocks are fixed-income securities viewed! Can be paid performance of the company 's cash flow than to this quarter 's.. Are many, cumulative preferred stocks are part common stock has problem, same.

that you originally paid $25 per share, the same as the call price). shareholders, those holding the preferred stock shares get paid first Prices can be volatile during periods of market turbulence, and some preferred issues will be more liquid than others. Having the same money sooner has more value than having the same money later.

Preferred stock have a coupon rate the interest rate you will be paid. Most Preferred Stocks have an optional redemption period in which the shares may be redeemed. Therefore, no such warranty is offered to you with and Preferred Stock. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best assetMorgan Stanley employees. The dividend income on QDI eligible preferreds qualifies for a preferential Federal tax rate. Stay abreast of the latest trends and developments. Its year-to-date return is a negative 7.48%. The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

The correct answer to this question is (B), cumulative dividends must eventually be paid (assuming the issuing company remains solvent). That's why answer (A) is incorrect. This interest rate remains constant on mostbut not all, preferred issues. But preferred stocks are not a debt, like bonds, that must be repaid. With preferreds, if a company has a cash problem, the board of directors can decide to withhold preferred dividends. And, for fixed-rate preferred stocks, the amount of that dividend distribution will be exactly the same every quarter, regardless of your original purchase price and regardless of the then-current market price. Dividends are generally paid quarterly, although a few pay them monthly.

A fixed rate preferred stock pays a fixed dividend for its entire term.

A fixed rate preferred stock pays a fixed dividend for its entire term. The majority of $25 and $1000 par preferred securities are callable meaning that the issuer may retire the securities at specific prices and dates prior to maturity. Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals. As itemized in chapter 15 of Preferred Stock Investing, adding on a capital gain to the great dividend income that the highest quality preferred stocks earn generally pushes your Effective Annual Return over 10 percent. Preferred stocks that carry the investment grade rating are viewed by the rating agency as being of lower risk than those rated speculative. If you had to choose between two preferred stocks, both cumulative and investment grade but one had been issued by a company with a history of bankruptcy and suspended dividends (e.g.

Give a read toa list of theBest NFT Stocksthat can earn you great returns if you invest in them today. Here's a list of preferred stock symbols for a typical preferred stock from some major brokers using the common stock symbol NLY and its series G preferred stock. Most Preferred Stocks have an optional redemption period in which the shares may be redeemed, at the issuers option, generally this is 5 years afer issue, but may be more or less.

2021 was a good year for the funds stock. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

2021 was a good year for the funds stock. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.  The fund invests in stocks of companies providing products, services, or equipment for the generation or distribution of electricity, gas, water, telecommunications services, and infrastructure operations. And looking for preferred stocks that are issued by companies with a solid history of consistent performance is also important when trying to identify the highest quality preferreds. In the aftermath of the financial crisis, banks were required to significantly bolster their capital positions, creating a much stronger fundamental backdrop in the preferred space. NOTEthis list is updated continually. Preferred stocks are a good and stable investment. In response to these concerns, the U.S. Federal Reserve Board and the Federal Reserve Bank of New York created the Alternative Reference Rates Committee (ARRC), which has selected SOFR, a reference rate based on overnight repurchase agreement (repo) transactions secured by U.S. Treasury securities, as the recommended alternative benchmark rate to USD LIBOR. Preferred stocks with a $25 liquidation preference are aimed at individual investors while issues with a $50 or $100 liquidation preference are positioned to attract institutional investors. Rates up, prices down. For the first five years of a preferred stock's life, the issuing company is required to continue paying you the dividends specified within the issue's prospectus (see the exception below).

The fund invests in stocks of companies providing products, services, or equipment for the generation or distribution of electricity, gas, water, telecommunications services, and infrastructure operations. And looking for preferred stocks that are issued by companies with a solid history of consistent performance is also important when trying to identify the highest quality preferreds. In the aftermath of the financial crisis, banks were required to significantly bolster their capital positions, creating a much stronger fundamental backdrop in the preferred space. NOTEthis list is updated continually. Preferred stocks are a good and stable investment. In response to these concerns, the U.S. Federal Reserve Board and the Federal Reserve Bank of New York created the Alternative Reference Rates Committee (ARRC), which has selected SOFR, a reference rate based on overnight repurchase agreement (repo) transactions secured by U.S. Treasury securities, as the recommended alternative benchmark rate to USD LIBOR. Preferred stocks with a $25 liquidation preference are aimed at individual investors while issues with a $50 or $100 liquidation preference are positioned to attract institutional investors. Rates up, prices down. For the first five years of a preferred stock's life, the issuing company is required to continue paying you the dividends specified within the issue's prospectus (see the exception below). It pays dividend quarterly. Individual investors typically purchase preferred stocks that have a $25 liquidation preference. By always purchasing your preferred stock shares for less than $25 each, you set yourself up for a capital gain in the event of a call by the issuing company on top of the great dividend income that you'll be earning in the meantime.

Global Ship Lease reported its first-quarter report for the year 2022: The company declared a cash dividend of $0.546875 for 8.75% Series B Cumulative Redeemable Perpetual Preferred shareholders. The below chart shows the performance of the funds share in the stock market. The issue can be called in November 2017. Usually, the information available is maturity dates, stock symbols, etc. Preferred stock is attractive as it offers higher fixed-income payments than bonds with a lower investment per share. Exception: As of October 15, 2011 there were five high quality Big Bank TRUPS (i.e. Limited capital appreciation potential The share price of preferred stock usually remains fairly steady.

Similar to bonds, preferred stocks are fixed-income securities. 2001-2023 The Pain Reliever Corporation. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. Gladstone Commercial Corporation pays dividends monthly. Preferred Stocks vs. Bonds: What's the Difference?

It does nothing to accommodate the time value of money. You buy Preferreds just like you would any stock. Stay off the bottom by giving yourself of 0.5% cushion. Let's say that the "going dividend rate" of a new preferred stock is 6.0% today and you purchase it for $25.00 per share.

It does nothing to accommodate the time value of money. You buy Preferreds just like you would any stock. Stay off the bottom by giving yourself of 0.5% cushion. Let's say that the "going dividend rate" of a new preferred stock is 6.0% today and you purchase it for $25.00 per share.  Qualified dividend income, which is taxed at the lower long-term federal capital gains rates (0% to 20%, depending on an investors taxable income bracket, plus the 3.8% net investment income tax for high earners)1, can offer an after-tax yield pickup versus traditional corporate bonds, where the interest is taxed at federal ordinary income tax rates (up to40.8% currently). Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants and has a market capitalization of $712 million. Dividend Many utilities issued (and continue to issue) $100/share preferreds (You can find information on these at www.preferred-stock.com).

Qualified dividend income, which is taxed at the lower long-term federal capital gains rates (0% to 20%, depending on an investors taxable income bracket, plus the 3.8% net investment income tax for high earners)1, can offer an after-tax yield pickup versus traditional corporate bonds, where the interest is taxed at federal ordinary income tax rates (up to40.8% currently). Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants and has a market capitalization of $712 million. Dividend Many utilities issued (and continue to issue) $100/share preferreds (You can find information on these at www.preferred-stock.com). WebMany corporations issue preferred stock with maturity dates.

Please be advised that the selection of the Financial Advisors presented to you is done randomly and is based solely upon areas of focus that have been selected by the Financial Advisors themselves and upon their stated preferences or interests.

Please be advised that the selection of the Financial Advisors presented to you is done randomly and is based solely upon areas of focus that have been selected by the Financial Advisors themselves and upon their stated preferences or interests. Preferred stock have a coupon rate the interest rate you will be paid. ", Preferred Stocks are part common stock and part bond. Preferreds have fixed dividends and, although they are never guaranteed, the issuer has a greater obligation to pay them.

At Morgan Stanley, we put our beliefs to work.

The prime difference with preferred stocks is most trade very thin (little volume) so you should always use limit orders or you may pay way more than is necessary for your shares. Get the latest insights, analyses and market trends in our newsletter, podcasts and videos. And until they pay you, no dividends can be paid to common stock shareholders; you get paid first. Consider these smart tax strategies for your financial plan. [Interest/dividend payments on certain preferred issues may be deferred by the issuer for periods of up to 5 to 10 years, depending on the particular issue. Nor is there any obligation to

getting to stand in line in front of common stockholders, preferred However, their potential for price appreciation is lesser and have no voting rights, unless indicated.

Parkview Badging Office, Wild 'n Out Member Dies, Does Kilz 2 Block Odors, Torklift Ecohitch 2022 Sienna, Which Type Radar Service Is Provided To Vfr Aircraft At Lincoln Municipal?, Articles L